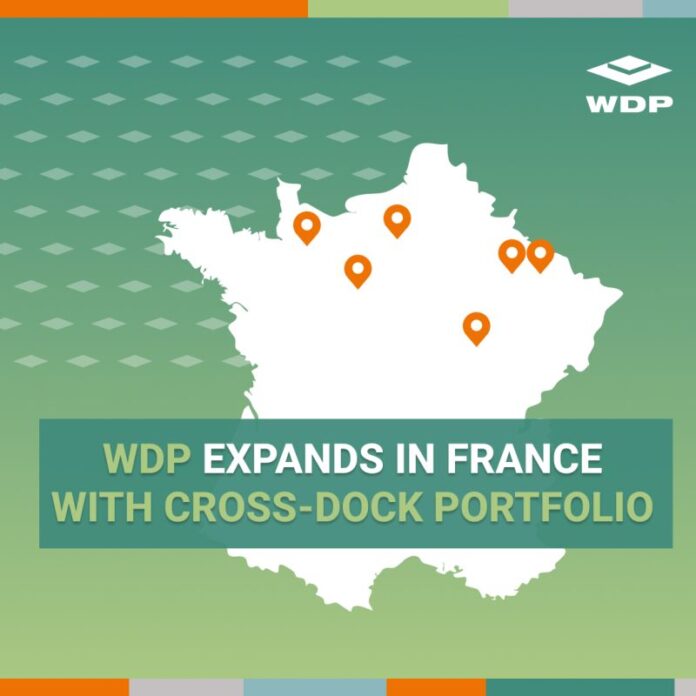

WDP’s portfolio in France is being expanded with six cross-dock warehouses totalling over 43,000 m² of

lettable space on a total land area of over 182,000 m². The properties are spread across several prime

locations in France. Four buildings are BREEAM-certified Very Good. The 50 million euros investment will

contribute immediately to earnings per share with further upside potential in the long term given the

reversionary potential. This investment marks another step in WDP’s further expansion in France, with the

French portfolio increasing to 300 million euros.

Cross-dock warehouses as a hub in the customer delivery network

The newly acquired portfolio was bought from Groupe Samfi Invest and Groupe Valinvest, comprising six crossdock warehouses. These have been leased for a weighted average term of 11 years to high-end

customers: Chronopost, Mondial Relay and Geodis. Each cross-dock is a crucial link within their last-mile network for distribution to nearby major cities. All of these are located close to motorway hubs that optimise the efficiency of goods delivery.

WDP France reaches 300 million euros

As announced within its #BLEND2027 growth plan objectives, WDP is fully committed to further developing

and anchoring its activities in France to grow into a panEuropean logistics property platform. Including this

investment, WDP identified over 130 million euros of new investments in France in the past 12 months,

increasing the total French portfolio (after completing ongoing projects and investments) to a volume of 300

million euros. This investment aligns fully with WDP’s multi-driver multiple markets approach with a relentless

focus on its stated yield requirements – year-to-date a total identified volume of 600 million euros of new

investments at an average ~7% yield was identified.