CapitaLand Investment Limited (CLI) has announced a significant increase in its capital deployment momentum in Southeast Asia, marked by four strategic acquisitions and the closure of a core logistics fund in Japan. These moves are set to double CLI’s funds under management (FUM) in Southeast Asia to approximately S$1.2 billion, solidifying the company’s position as a leading real estate investment manager in the region.

Strategic Acquisitions in Southeast Asia

CLI has successfully completed three key acquisitions in Southeast Asia, focusing on the burgeoning sectors of self-storage, logistics, and wellness-hospitality. These acquisitions include two industrial properties in Singapore by Extra Space Asia, a self-storage platform managed by CLI, and the purchase of OMEGA 1 Bang Na, a 20-hectare freehold site in Bangkok, Thailand, by the CapitaLand SEA Logistics Fund (CSLF).

In addition, the CapitaLand Wellness Fund (C-WELL) has completed a joint acquisition of a freehold lodging property in Singapore. These acquisitions, upon the completion of their development, represent a total investment value of approximately S$700 million.

Expanding Self-Storage Solutions with Extra Space Asia

Extra Space Asia, one of the largest self-storage operators in Asia, is expanding its portfolio in Singapore by acquiring two strategically located industrial assets. These properties will be converted into self-storage facilities, adding approximately 320,000 square feet of gross floor area to the platform’s offerings. This expansion is in response to the strong and growing demand for self-storage solutions in Singapore, and it underscores CLI’s focus on value-add strategies and sustainable growth.

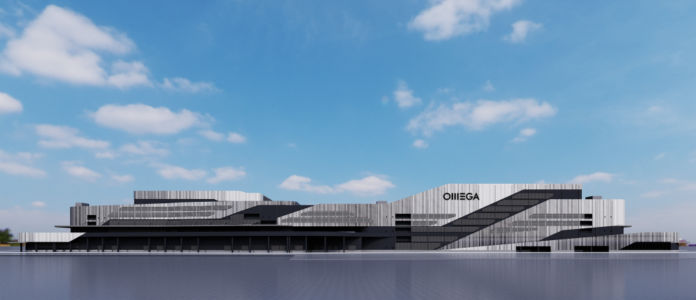

Launching a State-of-the-Art Logistics Campus in Thailand

The CapitaLand SEA Logistics Fund’s acquisition of OMEGA 1 Bang Na in Thailand marks CLI’s first logistics property in the country. This project will develop a state-of-the-art automated logistics campus, featuring advanced smart warehousing solutions. Located along the Bang Na Trat Highway, the logistics campus will be Thailand’s largest standalone warehouse, strategically positioned to offer excellent connectivity to key transport hubs.

Growing the Wellness-Hospitality Ecosystem

C-WELL’s acquisition of a freehold lodging property in Singapore’s downtown core district represents CLI’s commitment to the wellness and healthcare real estate sector. The property will be upgraded and rebranded under Ascott’s lyf brand, catering to the growing demand for experience-led social living. This move aligns with C-WELL’s strategy to invest in assets across the healthcare, medical, wellness, and preventive care spectrum, with a focus on Southeast Asia.

Closing a New Logistics Fund in Japan

In addition to its Southeast Asia activities, CLI has closed a new core logistics private fund in Japan, raising S$154.8 million (JPY16.5 billion). This fund has been fully deployed to acquire two green-certified logistics assets in Greater Tokyo and Osaka, further expanding CLI’s footprint in the logistics sector in Asia.

Looking Ahead

Patricia Goh, CEO of Southeast Asia Investment at CLI, emphasized the strategic importance of these acquisitions in driving the next phase of growth for CLI’s managed funds. The company plans to continue identifying investment opportunities across Southeast Asia, leveraging its expertise in value creation and its strong operating capabilities to deliver sustainable returns for investors.

These strategic moves highlight CLI’s commitment to expanding its presence in key growth sectors and markets across Asia, positioning the company to capitalize on long-term mega trends such as urbanization, supply chain rationalization, and evolving consumer preferences.